CASE STUDY: ACR COORDINATES $2.7M CAT LOSS ALONGSIDE INSURANCE ADJUSTER

ACR IS PROUD TO HAVE BEEN AN INTEGRAL PARTNER IN THIS PROJECT

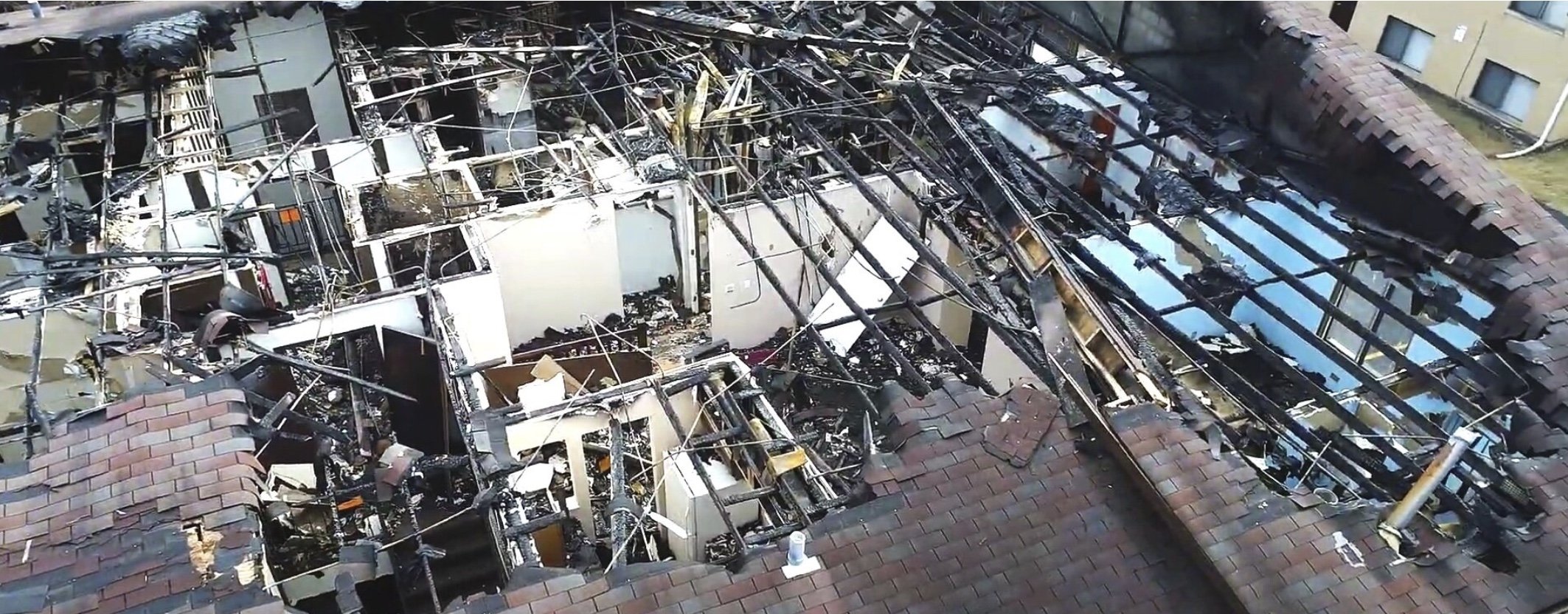

In January 2018, a midwest 11-unit condominium complex caught fire when a plumber was doing work in the attic of an unoccupied unit. This $2.7M CAT loss resulted in significant structural damage and as you can imagine, a massive property claim.

There were many bumps along the way. First, was a disagreement on whether to add a temporary roof or tarp to the structure to preserve its current state. A tarp wasn’t ideal because the roof was in awful shape, so the building sat exposed to the elements for almost one full year while the claim was still processing. Being located in the midwest meant a cold, snowy winter with additional losses post-fire. ACR jumped in and conducted this CAT loss from beginning to end with many hurdles to overcome.

HERE WERE THE SIX MAJOR CHALLENGES ACR HAD TO OVERCOME FOR THIS LARGE LOSS PROJECT:

ACR was working with a property manager who didn’t have experience with a project of this magnitude. As a result, she was stretched very thin, which made ongoing communication difficult. As a result, ACR took responsibility for working closely with the insurance adjuster and other parties to streamline the process.

It was the year of the Polar Vortex, which meant heavy snow, subzero temperatures, and gusty winds. This combination caused the structure to become unstable, with shifting that caused broken pipes. This plumbing mishap caused the sitting water from the fire to freeze into a virtual ice rink. The challenges didn’t stop there. Because of the inclement weather, ACR deployed more mitigation tactics because of continuous weather changes.

Simultaneously, there was a huge asbestos issue throughout the building, which required immediate attention before any other work could commence. None of the 11 unit owners had content-coverage for asbestos. Naturally, this created a conflict of getting the tenants' remediation paid because the contents had to be abated before a payout. ACR had to negotiate a settlement with 12 different insurance carriers.

By this time, Additional Living Expense (ALE) coverage was running out. Most individual condo policies contain this type of coverage in case a policyholder needs to relocate while the restoration process takes place. Almost all of the tenants’ policies had 10-months of coverage, yet residents were displaced for almost 2 years, which meant ACR had more negotiations to work through.

Because the building was older, several building codes required an upgrade — most notably, the sprinkler systems. The coverage of cost to “restore to original condition” was no longer applicable, which created a huge expense that had to be negotiated by ACR. Continuing without up-to-code systems would have caused an illegal restoration, which would not be covered by the insurance companies.

In the end, all units had to be rebuilt from the ground-up, and ACR worked closely with each resident to select unit finishes like cabinets, flooring, and windows. Plus, manage their insurance budgets to make sure they were on target. ACR employed a full-time kitchen and bath designer to help each resident with their selection process and provided coordination with the construction team for installation.

FOR ACR, ALL OF THE EFFORTS, MAN-HOURS, AND PIVOTING WERE NO MATCH FOR THE REWARD OF HELPING THESE RESIDENTS GET TO LIVING SAFELY AND COMFORTABLY IN THEIR HOMES.

For three decades, ACR has been the trusted “go-to” for countless Insurance Adjusters, Property Managers, and Claims Managers.